Added 1 share of Grab

Added 200 shares of Singpost

Added 200 shares of Japan Foods

Added 31 shares of Nikko AM STI ETF

Added $200 of Syfe REITS

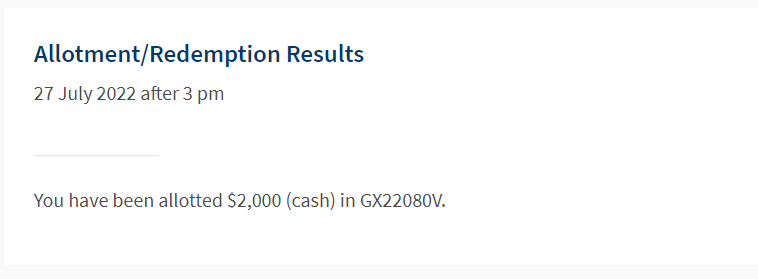

Added $2,000 of Singapore Savings Bonds

What have I done?

A month of many activities and learning in the stock market for me.

Did not know that premarket and post market trading in the US is actually a thing.

Also got to know that dividend yield % is not everything! Dividend payout price is also an important factor.

One of the first few investment activity in July was to take up the SSB (Singapore Savings Bond). At 3% average return, it's the highest in a long while. My intention is to park a portion of my emergency funds in this bond. A $2 fee for applying and another $2 if redeemed early is all that is required for this bond. Interest earned will be paid out every 6 months (Feb & Aug every year). Shall see what the bond for Sep22 offers and may take up another one if the interest rate is good.

No comments:

Post a Comment